NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT)) (EACH, A U.S. PERSON) OR IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

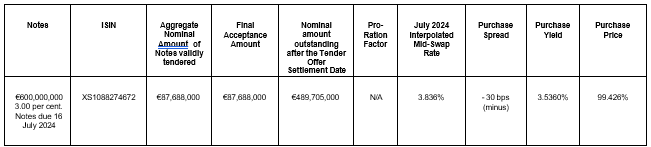

Further to the indicative results announcement made earlier today, 2i Rete Gas S.p.A. (the Offeror) hereby announces the results of its invitation to all holders (the Noteholders) of its

€600,000,000 3.00 per cent. Notes due 16 July 2024 (ISIN: XS1088274672) (the Notes), out of which

€577,393,000 is currently outstanding, to tender the Notes for purchase by the Offeror for cash up to an aggregate maximum acceptance amount of €300,000,000 in aggregate nominal amount, subject to the Offeror’s right in its sole and absolute discretion to increase or decrease such amount (the Maximum Acceptance Amount) subject to the satisfaction of the New Issue Condition and the other conditions described in the tender offer memorandum dated 30 May 2023 (the Tender Offer Memorandum) (the Offer).

The Offer was announced on 30 May 2023 and was made subject to the offer and distribution restrictions set out in the Tender Offer Memorandum. Capitalised terms used in this announcement and not otherwise defined have the meanings ascribed to them in the Tender Offer Memorandum.

As stated in the indicative results announcement, the New Issue Condition has been satisfied on 6 June 2023.

The Offeror hereby announces that, as stated in the indicative results announcement, it accepts for purchase any and all valid tenders of Notes pursuant to the Offer up to a Maximum Acceptance Amount of

€300,000,000.

The final results and pricing details for the Offer are set out below. The Purchase Price in respect of the Notes accepted for purchase was determined at or around 1.00 p.m. (CEST) today in the manner described in the Tender Offer Memorandum by reference to the sum of the Purchase Spread and the July 2024 Interpolated Mid-Swap Rate (such sum, the “Purchase Yield”) for the Notes as set out below.

The total amount that will be paid to each Noteholder on the Tender Offer Settlement Date for the Notes accepted for purchase from such Noteholder will be an amount (rounded to the nearest €0.01, with €0.005 rounded upwards) equal to the sum of:

(a) the product of (i) the aggregate nominal amount of such Notes accepted for purchase from such Noteholder pursuant to the Offer and (ii) the Purchase Price; and

(b) the Accrued Interest Payment on such Notes.

The settlement of the Offer is expected to occur on 9 June 2023.