NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT)) (EACH, A U.S. PERSON) OR IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

Further to the indicative results announcement made earlier today, 2i Rete Gas

S.p.A. (the Offeror) hereby announces the final results of its invitation to all holders (the Noteholders) of its outstanding €750,000,000 1.75 per cent. Notes due 16 July 2019 (ISIN: XS1088274169) (the 2019 Notes) and its outstanding €540,000,000 1.125 per cent. Notes due 2 January 2020 (ISIN: XS1144492532) (the 2020 Notes and together with the 2019 Notes, the Notes and each a Series) to tender their Notes for purchase by the Offeror for cash up to €225,000,000 in aggregate nominal amount of the Notes (the Maximum Acceptance Amount, although the Offeror reserved the right, in its sole and absolute discretion and for any reason, to change the Maximum Acceptance Amount or to accept less than or more than the Maximum Acceptance Amount (or not to accept any Notes) for purchase pursuant to the Offers), subject to the satisfaction of the conditions described in the tender offer memorandum dated 10 January 2017 (the Tender Offer Memorandum) (the Offers and each an Offer).

The Offers were announced on 10 January 2017 and were made subject to the offer and distribution restrictions set out in the Tender Offer Memorandum. Capitalised terms used in this announcement and not otherwise defined have the meanings ascribed to them in the Tender Offer Memorandum.

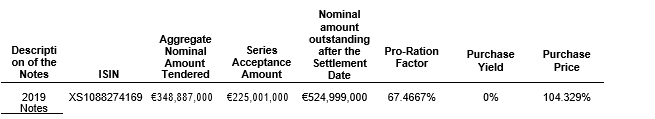

The Offeror hereby announces that (i) the Maximum Acceptance Amount shall be €225,001,000; (ii) it accepts valid tenders of 2019 Notes pursuant to the relevant Offer for an aggregate nominal amount equal to the Maximum Acceptance Amount as set out in the table below and (iii) as stated in the indicative results announcement, it does not accept for purchase any of the 2020 Notes validly tendered pursuant to the relevant Offer.

As stated in the indicative results announcement, the 2019 Notes Purchase Price and any Accrued Interest for the 2019 Notes were determined at or around 1.00 p.m. (CET) today in the manner described in the Tender Offer Memorandum. The final details in respect of the 2019 Notes are set out below:

The Accrued Interest for the 2019 Notes accepted for purchase is 0.921 per cent.

The total amount that will be paid to each Noteholder on the Settlement Date for the 2019 Notes accepted for purchase from such Noteholder will be an amount (rounded to the nearest €0.01, with €0.005 rounded upwards) equal to the sum of:

(a) the product of (i) the aggregate nominal amount of such 2019 Notes accepted for purchase from such Noteholder pursuant to the relevant Offer and (ii) the 2019 Notes Purchase Price; and

(b) the Accrued Interest Payment on such 2019 Notes.

Settlement is expected to occur on 24 January 2017.

Questions and requests for assistance in connection with the Offers may be directed to:

OFFEROR

2i Rete Gas S.p.A.

Via Alberico Albricci, 10 20122 Milan

Italy

STRUCTURING ADVISORS AND DEALER MANAGERS

Merrill Lynch International

2 King Edward Street London EC1A 1HQ

United Kingdom Telephone: +44 (0) 20 7996 5420

Attention: Liability Management Group Email: DG.LM_EMEA@baml.com

Société Générale

10 Bishops Square London E1 6EG United Kingdom

Telephone: +44 20 7676 7680 Attention: Liability Management

Email: liability.management@sgcib.com

TENDER AGENT

Lucid Issuer Services Limited

Tankerton Works 12 Argyle Walk

London WC1H 8HA United Kingdom

Attention: Paul Kamminga / Arlind Bytyqi

Telephone: +44 20 7704 0880

Email: 2iretegas@lucid-is.com

None of the Dealer Managers, the Tender Agent or any of their respective directors, officers, employees, agents or affiliates assumes any responsibility for the accuracy or completeness of the information concerning the Offeror, the Notes or the Offers contained in this announcement or in the Tender Offer Memorandum.