NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT)) (EACH, A U.S. PERSON) OR IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

2i Rete Gas S.p.A. (the Offeror) hereby announces, on a non-binding basis, the indicative results of its invitation to all holders (the Noteholders) of its €750,000,000 1.75 per cent. Notes due 16 July 2019 (ISIN: XS1088274169) (of which €524,999,000 are currently outstanding) (the 2019 Notes) and its outstanding €540,000,000 1.125 per cent. Notes due 2 January 2020 (ISIN: XS1144492532) (the 2020 Notes and together with the 2019 Notes, the Notes and each a Series) to tender respectively (i) any and all of the 2020 Notes for purchase by the Offeror for cash and (ii) the 2019 Notes for purchase by the Offeror for cash up to an aggregate maximum acceptance amount of €400,000,000 in aggregate nominal amount less the aggregate nominal amount of the 2020 Notes validly tendered and accepted for purchase by the Offeror, subject to the Offeror’s right in its sole and absolute discretion to increase or decrease such amount (the 2019 Notes Maximum Acceptance Amount) in each case subject to the satisfaction of the New Issue Condition and the other conditions described in the tender offer memorandum dated 14 February 2017 (the Tender Offer Memorandum) (the Offers and each an Offer).

The Offers were announced on 14 February 2017 and were made subject to the offer and distribution restrictions set out in the Tender Offer Memorandum. Capitalised terms used in this announcement and not otherwise defined have the meanings ascribed to them in the Tender Offer Memorandum.

The Offeror hereby announces its non-binding intention, subject to, inter alia, satisfaction (or waiver) of the New Issue Condition, to accept for purchase any and all valid tenders of Notes pursuant to the relevant Offer up to a maximum aggregate amount of €435,106,000, irrespective of the 2019 Notes Maximum Acceptance Amount.

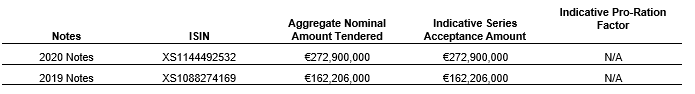

The following table sets out the aggregate nominal amount of Notes validly tendered pursuant to the relevant Offer, the indicative Series Acceptance Amounts and the indicative Pro-Ration Factor in relation to the Notes.

As soon as reasonably practicable today, the Offeror shall make a further announcement of whether it will, subject to the satisfaction (or waiver) of the New Issue Condition, accept and purchase validly tendered Notes of any Series pursuant to the relevant Offer and, if so, (i) the 2019 Notes Acceptance Amount, (ii) the 2020 Notes Acceptance Amount, (iii) in relation to each Series of Notes, the aggregate nominal amount of Notes validly tendered, (iv) the 2019 Notes Purchase Price, (v) the 2020 Notes Purchase Price and (vi) any Accrued Interest for the Notes accepted for purchase.

Subject to satisfaction (or waiver) of the New Issue Condition, settlement is expected to occur as soon as practicable on the New Issue Settlement Date which is expected to be on 28 February 2017.

Questions and requests for assistance in connection with the Offers may be directed to:

OFFEROR

2i Rete Gas S.p.A.

Via Alberico Albricci, 10 20122 Milan

Italy

DEALER MANAGERS

Banca IMI S.p.A.

Largo Mattioli, 3

20121 Milan Italy

Attention: Liability Management Telephone: +39 02 7261 5938

Email: Liability.Management@bancaimi.com

Mediobanca – Banca di Credito Finanziario S.p.A.

Piazzetta Enrico Cuccia, 1 20121 Milan

Italy

Attention: Liability Management Group Telephone: +39 02 8829 840

Email: MB_LM_CORP_IT@mediobanca.com

Société Générale

10 Bishops Square London E1 6EG United Kingdom

Attention: Liability Management Telephone: +44 20 7676 7680

Email: liability.management@sgcib.com

BNP Paribas

10 Harewood Avenue London NW1 6AA United Kingdom

Attention: Liability Management Group Telephone: +44 (0)20 7595 8668

Email: liability.management@bnpparibas.com

Merrill Lynch International

2 King Edward Street London EC1A 1HQ

United Kingdom

Attention: Liability Management Group Telephone: +44 (0) 20 7996 5420 Email: DG.LM_EMEA@baml.com

UniCredit Bank AG

Arabellastrasse 12

81925 Munich Germany

Attention: Liability Management Telephone: +49 89 3781 3722 Email: corporate.lm@unicredit.de

TENDER AGENT

Lucid Issuer Services Limited

Tankerton Works 12 Argyle Walk

London WC1H 8HA United Kingdom

Attention: Arlind Bytyqi / Paul Kamminga

Telephone: +44 20 7704 0880

Email: 2iretegas@lucid-is.com

None of the Dealer Managers, the Tender Agent or any of their respective directors, officers, employees, agents or affiliates assumes any responsibility for the accuracy or completeness of the information concerning the Offeror, the Notes or the Offers contained in this announcement or in the Tender Offer Memorandum.