THE BOARD OF DIRECTORS OF 2i RETE GAS APPROVES THE 2021 CONSOLIDATED RESULTS

The Board of Directors of 2i Rete Gas S.p.A. approved today the consolidated results at 31 December 2021 and resolved to propose the distribution of a dividend of 105 million euro in dividends to the Shareholders’ Meeting called for 28 April 2022.

Financial highlights

- Revenues: 757.4 million euro (+2.0%)

- Adjusted EBITDA: 517.2 million euro (+6.0%)

- Adjusted EBIT: 310.5 million euro (+6.8%)

- Net profit: 211.2 million euro (+14.9%)

- Adjusted net profit: 177.7 million euro (+6.9%)

- Investments: 348.2 million euro (+10.8%)

- Net fixed assets: 3,917.7 million euro (+7.9%)

- Adjusted net financial position: 2,854.1 million euro (+7.3%)

Operational highlights

- Active concessions: 2,193

- Active redelivery points: 4,521,498 (+3.8%)

- Distributed (Natural and LPG) gas in millions of m3: 6,395 (+10.8%)

- Km of pipelines operated: 69,864 (+4.6%)

In 2021, 2i Rete Gas S.p.A. reported 757.4 million euro in Revenues, net of line items offset with costs. This amount included 8 million euro in non-recurring items, related to the revenues pursuant to ARERA Resolution 559/21 for the recovery of non-depreciation of traditional meters disposed in the past years (so-called IRMA). Therefore, the adjusted Revenues 2021 totalled 749.4 million euro (718.5 million euro in 2020). The increase (+30.9 million euro) was essentially attributable to higher revenues from gas distribution due to the change in the scope of consolidation after the contribution of Infrastrutture Distribuzione Gas S.p.A. (“IDG”) from 30th April 2021.

In 2021, Adjusted operating costs amounted to 232.2 million euro (230.5 million euro in 2020) and did not include non-recurring expenses of 0.2 million euro. There was a growth in operating costs mainly due to the changes in the scope of consolidation, positively offset by the improved margin for energy efficiency certificates, lower raw material costs and other efficiencies.

The Adjusted EBITDA amounted to 517.2 million euro, 29.2 million euro higher than 2020 (+6.0%), through the contribution of the acquired company and operational efficiencies achieved in 2021.

The Adjusted EBIT totalled 310.5 million euro, 19.8 million euro higher than 2020 (+6.8%).

The Adjusted net profit was equal to 177.7 million euro, 11.4 million euro higher than 2020 (+6.9%). The 2021 non-recurring items concerned the overall positive fiscal impact (25.7 million euro) strictly related to the realignment of fiscal and statutory values of goodwill following mergers in the parent company.

During 2021, 2i Rete Gas put in place gross investments of 348.2 million euro (314.2 million euro in 2020), mainly as a result of the increased investments for technical improvement activities and renewal of the distribution network, despite the slowdown in investments in the massive replacement of smart meters.

Net fixed assets in 2021 totalled 3,917.7 million euro, 287.7 million euro higher compared to 31 December 2020 (+7.9%). The increase was driven by the change in the scope of consolidation of the Group and the normal trend of investments.

The Adjusted net financial position, including financial liabilities from IFRS16 principles application (equal to 25.6 million euro), rose from 2,660.0 million euro in 2020 to 2,854.1 in 2021 (+194.1 million euro). The growth was mainly due to the amount paid to Edison for the acquisition of IDG and higher technical investments.

The Adjusted net financial position/adjusted EBITDA ratio 2021 was equal to 5.5x, substantially in line with the previous year.

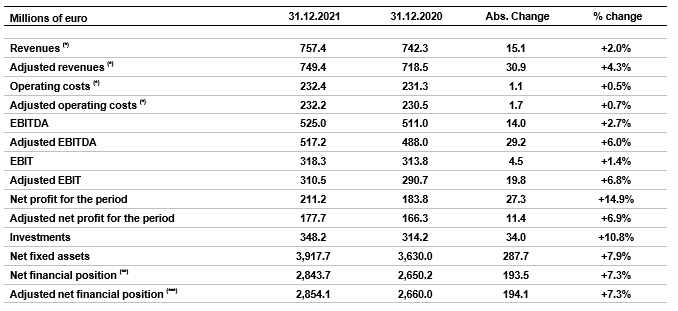

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (319.4 and 296.5 million euro in 2021 and 2020, respectively), are accounted for as a deduction of the relevant costs.

(**) Including the debt registered following the application of the IFRS16 principles (equal to 25.6 and 23.7 million euro in 2021 and 2020, respectively).

(***) Excluding the non-current financial assets for the costs on loan and the adjustment to the payables for transaction costs associated with loans pursuant to IAS 39 (10.3 and 9.8 million euro in 2021 and 2020, respectively).