THE BOARD OF DIRECTORS OF 2i RETE GAS APPROVES THE RESULTS AT JUNE 30th 2019

Today, the Board of Directors of 2i Rete Gas S.p.A. (“2iRG”), during the meeting chaired by Ms Paola Muratorio, approved the Consolidated Interim Financial Report at June 30th 2019.

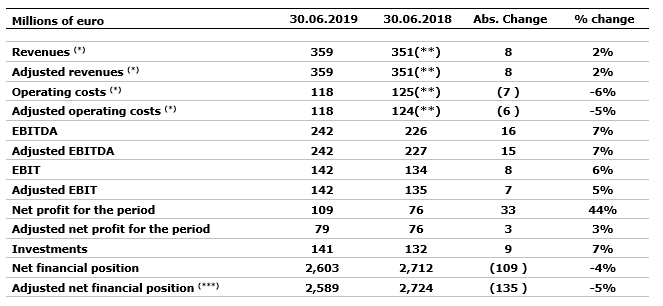

Financial highlights

- Revenues: 359 million euro (+2%)

- Adjusted EBITDA: 242 million euro (+7%)

- Adjusted EBIT: 142 million euro (+5%)

- Net profit for the period: 109 million euro (44%)

- Adjusted net profit for the period: 79 million euro (+3%)

- Investments: 141 million euro (+5%)

- Adjusted net financial position: 2,589 million euro (-5% compared to June 30th 2018)

Operating highlights

- Active concessions: 2,141

- Active redelivery points: 4,333,708 (-1,1% compared to June 30th 2018)

- Distributed (natural and LPG) gas in millions of m3: 3,628 (+0.6% vs. June 30th 2018)

- Km of pipelines operated: 65,859 (-0.3% compared to June 30th 2018)

Michele De Censi, 2iRG Chief Executive Officer and General Manager, has commented as follows:

“The results of the first half of the current year show the positive operating costs’ optimization trend; 2i Rete Gas achieved targets over the expectations.

During the first half of the 2019 the Company completed the disposal of some concessions in the areas of Bari and Foggia, achieving a capital gain of more than 16 million euro, in compliance with the Antitrust Authority’s provision which approved the acquisition of the distribution assets of Gas Natural in Italy.

In the second half of the year, the Company will carry forward the investments plan of the smart metering and the modernization plan of the distribution network, with special focus on technical innovation and digitalization.”

In the first half of the 2019, 2iRG reported 359 million euro of Revenues. The figure is offset with costs and includes non-recurring items (equal to zero during the analyzed period). Adjusted revenues item is therefore 359 million euro vs. 351 million euro of June 2018. The improvement essentially arises from higher revenues from gas distribution, thanks to a higher regulatory WACC.

Adjusted operating costs in the first half of 2019 totaled 118 million euro (vs.124 million euro reached in the previous period). The net decrease of about 6 million euro is mainly related to lower personnel costs and service costs.

Adjusted EBITDA amounted to 242 million euro, 15 million euro higher (+7%) than in June 2018. The improvement of the EBITDA in 2019 benefits from the application of IFRS16 accounting, which has enabled to reclassify certain categories of costs (about 2 million euro) in the A&D, instead of in the operating costs.

Adjusted EBIT amounted to 142 million euro, up 7 million euro (+5%) than in June 30th 2018.

The Adjusted net profit for the period is equal to 79 million euro, exceeding by 3 million euro (+3%) the result of the 1H 2018. In the first half of 2019 the special items are related to the fiscal impact of the redemption of the goodwill for 2IRG Impianti (14 million euro) and to the capital gain deriving from the disposal of Bari-Foggia assets (16 million euro).

In the first half of 2019, 2iRG’s gross investments amounted to 141 million euro (vs. 132 million euro, as of June 30th 2018). The increase was largely attributable to higher investments for the smart metering project, for the technical improvement of the distribution network and to new investments for the Cilento metanization (4 million euro).

The adjusted net financial position decreased from 2,724 million euro in the first half of 2018 to 2,589 million euro as of 30 June 2019 (-135 million euro). In addition to the positive operating performance, the net improvement is mainly due to Bari-Foggia assets disposal, with proceeds of 42 million euro, and to the reduction of the net working capital, in relation to the management of Energy Efficiency Certificates (“TEE”).

The following table illustrates the main financial figures of the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from the construction of distribution infrastructure recognised in accordance with IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (132 and 122 million euro in the first half of 2019 and 2018, respectively), are accounted for as a deduction of the relevant costs. (**) 2018 Revenues and Costs have been reinstated and they show the TEE net margin, in order to be comparable with June 2019 figures. (***) Excluding the adjustment to the payables for transaction costs associated with loans (13 and 12 million euro in the first half of 2019 and 2018, respectively) pursuant to IAS 39 and to the IFRS16 debt (equal to 27 million euro in 2019, not accounted in 2018)