The Shareholders’ Meeting of 2i Rete Gas S.p.A. approved today the separate and consolidated financial statements at 31 December 2019, showing a Net profit of 207 million euro, as well as the payment of 50 million euro in dividends, confirming the proposal the Board of Directors made on 25 March 2020.

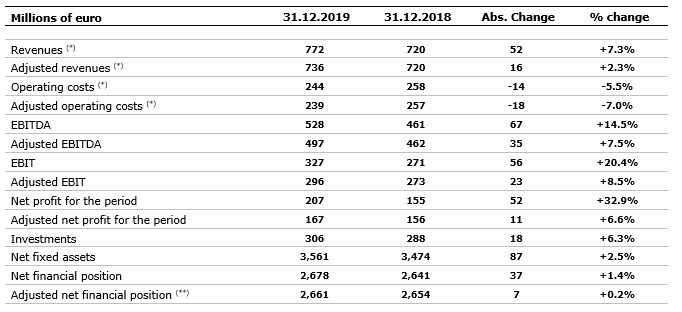

Financial highlights

- Revenues: 772 million euro (+7.3%)

- Adjusted EBITDA: 497 million euro (+7.5%)

- Adjusted EBIT: 296 million euro (+8.5%)

- Net profit: 207 million euro (+32.9%)

- Adjusted net profit: 167 million euro (+6.6%)

- Investments: 306 million euro (+6.3%)

- Adjusted net financial position: 2,661 million euro

Operational highlights

- Active concessions: 2,132

- Active redelivery points: 4,342,719 (-1.2%)

- Distributed (Natural and LPG) gas in millions of m3: 5,975 (-1.1%)

- Km of pipelines operated: 66,052 (-0.3%)

In 2019, 2i Rete Gas S.p.A. generated 772 million euro in Revenues, net of items which are offset in the costs. In Revenues are included non-recurring incomes for a total of 36 million euro which are related to the partial release of the fund concerning provision for tariff revenues as result of the positive conclusion of the litigation (21 million euro) and to the capital gain regarding the disposal of concessions in the area of Bari and Foggia. The adjusted Revenues, equal to 736 million euro, are about 16 million higher in comparison with 2018 (+2.3%). The increase is due mainly to bigger revenues driven by a higher regulator WACC.

In 2019, Adjusted operating costs amounted to 239 million euro (257 million euro in 2018) and did not include non-recurring expenses of 5 million euro. The latter are related to capital losses deriving from the disposal of the LPG branch and to adjustments for the disposed concessions. The decrease of 7.0% is mainly the consequence of the operating efficiency, implemented during the year, which has produced its positive effect on service and personnel costs.

The Adjusted EBITDA amounted to 497 million euro, up 35 million euro (+7.5%) in comparison with 2018.

The Adjusted EBIT totalled 296 million euro, 23 million euro higher than 2018 (+8.5%).

The Adjusted net profit was equal to 167 million euro, up 11 million euro from 2018 (+6.6%), due to the higher Adjusted EBIT and counterbalanced by the increase of financial losses and taxes. The 2019 non-recurring items concerned the positive fiscal impact strictly related to the redemption of the goodwill of 2i Rete Gas Impianti (14 million euro).

During 2019, 2i Rete Gas S.p.A. put in place gross investments of 306 million euro (288 million euro in 2018), increase mainly given by greater investments for technical improvement activities and renewal of the distribution network.

Net fixed assets in 2019, mainly represented by intangible assets related to gas distribution concessions, is equal to 3,561 million euro, 87 million euro higher compared to 31 December 2018 (+2.5%). The increase is driven by the normal trend of investments.

The Adjusted net financial position, which does not take into consideration 2019 financial liabilities from IFRS16 principles application (equal to 29 million euros), was up from 2,654 million euro in 2018 to 2,661 in 2019 (+7 million euro). Such trend is driven by more investments in tangible assets and reflects the normal dynamic of the business.

The Adjusted net financial position/adjusted EBITDA ratio at the end of 2019 decreased from

5.7x (as of December 2018) to 5.4x.

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (285 and 266 million euro in 2019 and 2018, respectively), are accounted for as a deduction of the relevant costs.

(**) Excluding the adjustment to the payables for transaction costs associated with loans (12 and 13 million euro in 2019 and 2018, respectively) pursuant to IAS 39 and to the debt registered following the application of the IFRS16 principles (equal to 29 million in 2019, not accounted in 2018).