We create and distribute value

Investors

We invest in the modernisation and digitisation of our infrastructure to actively drive the energy transition. This is our commitment to the future and to investors.

On this page you can find information on:

- results and documents

- debt and rating

- financial calendar

- price-sensitive communications.

Results and documents

Key figures

Below are the main indicators relating to the latest results available.

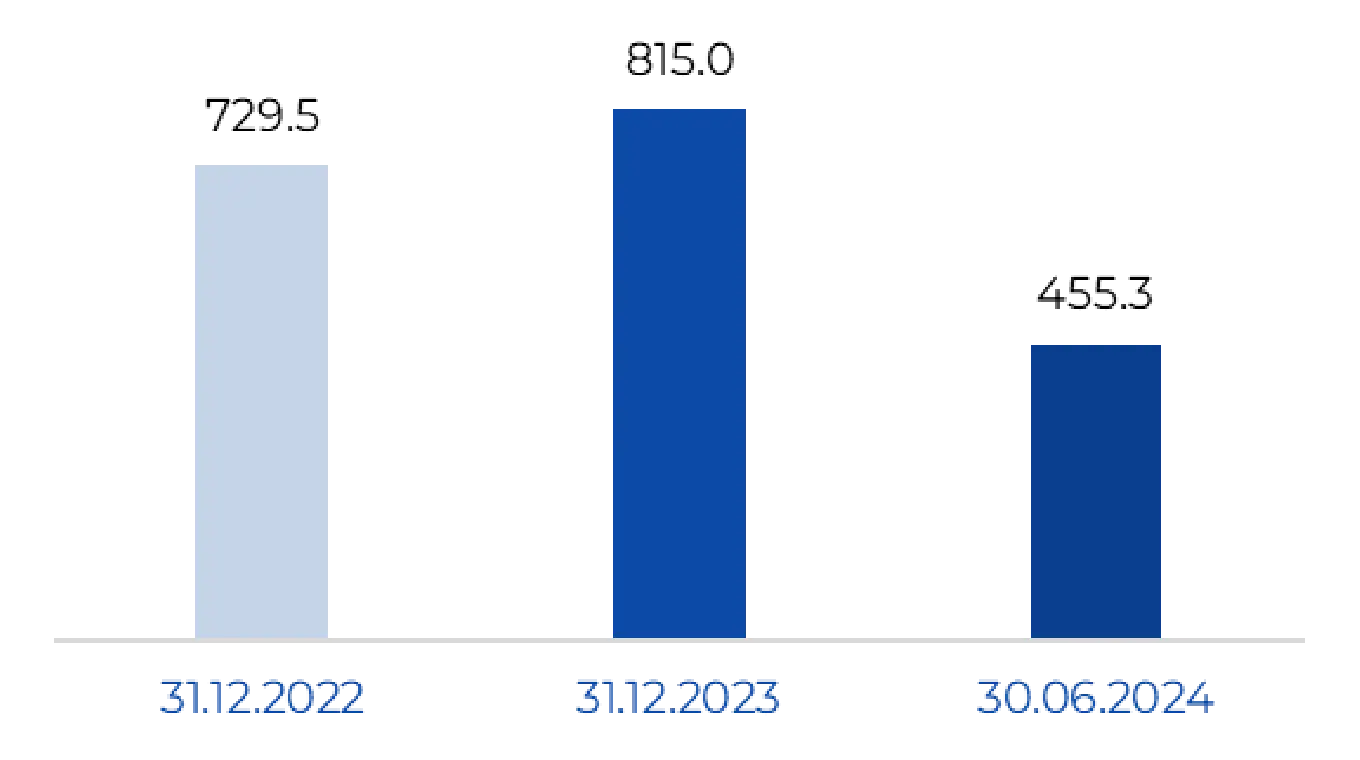

Revenues*

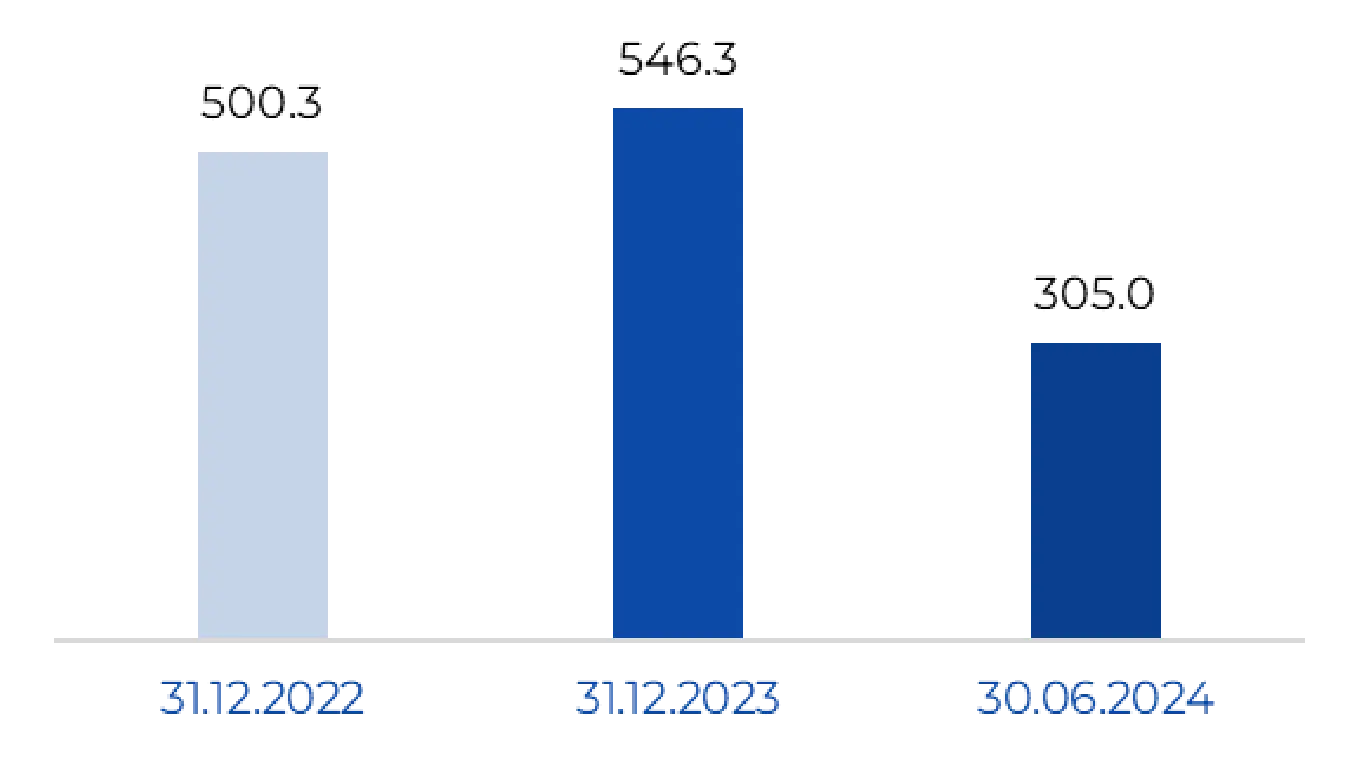

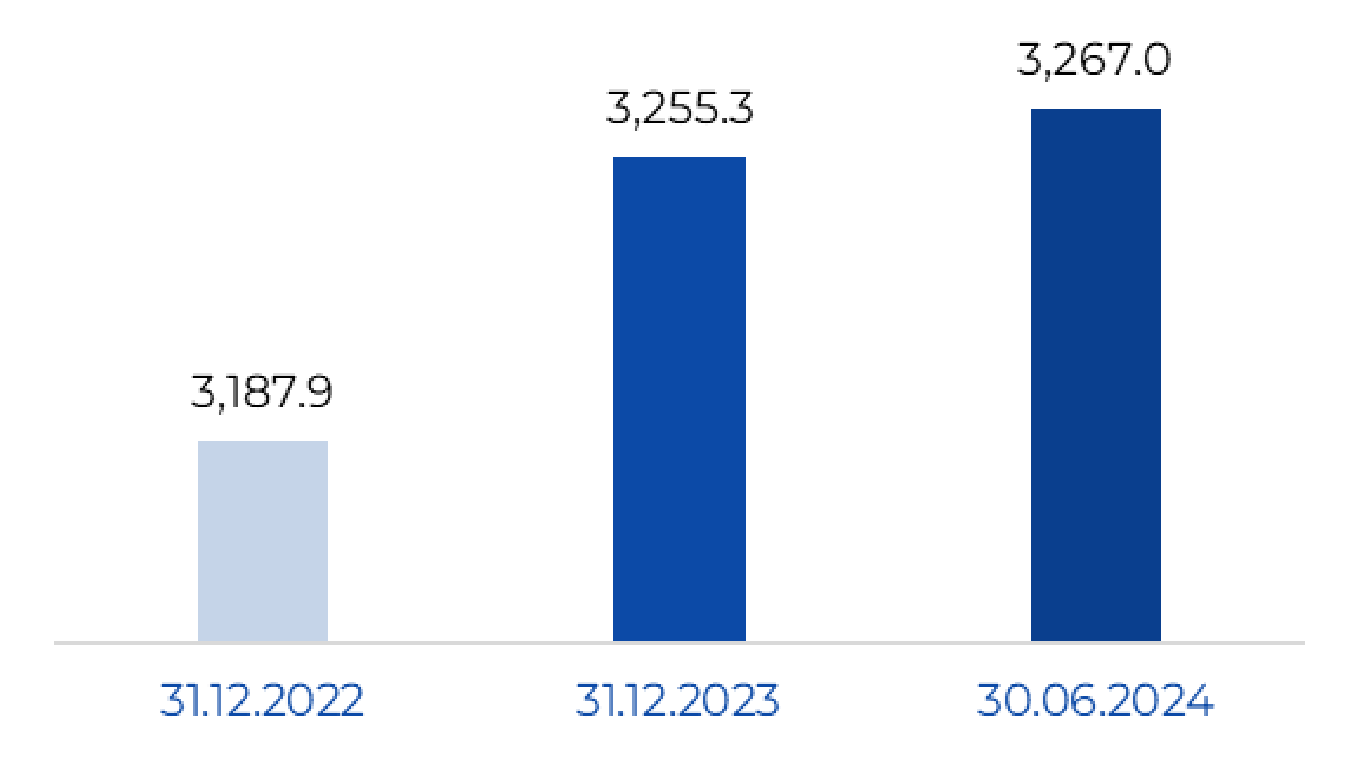

Net income*

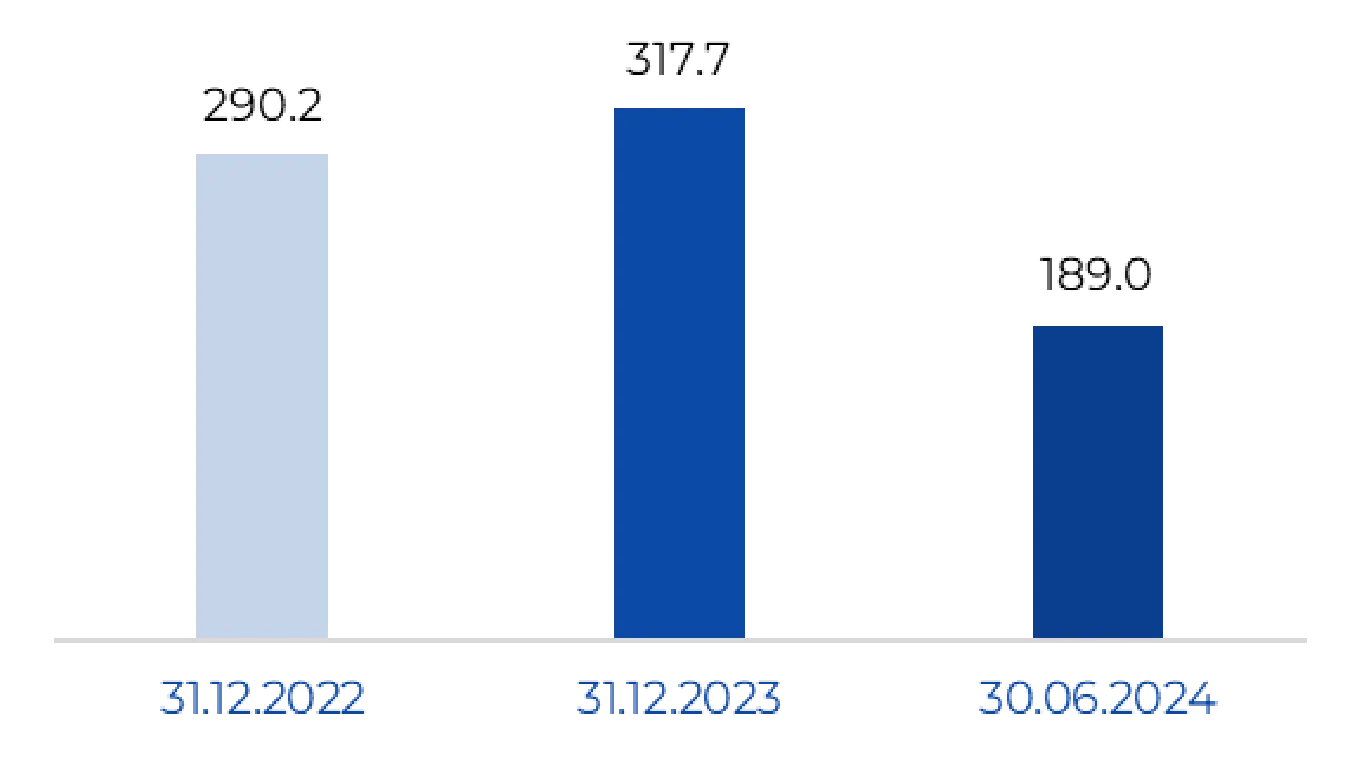

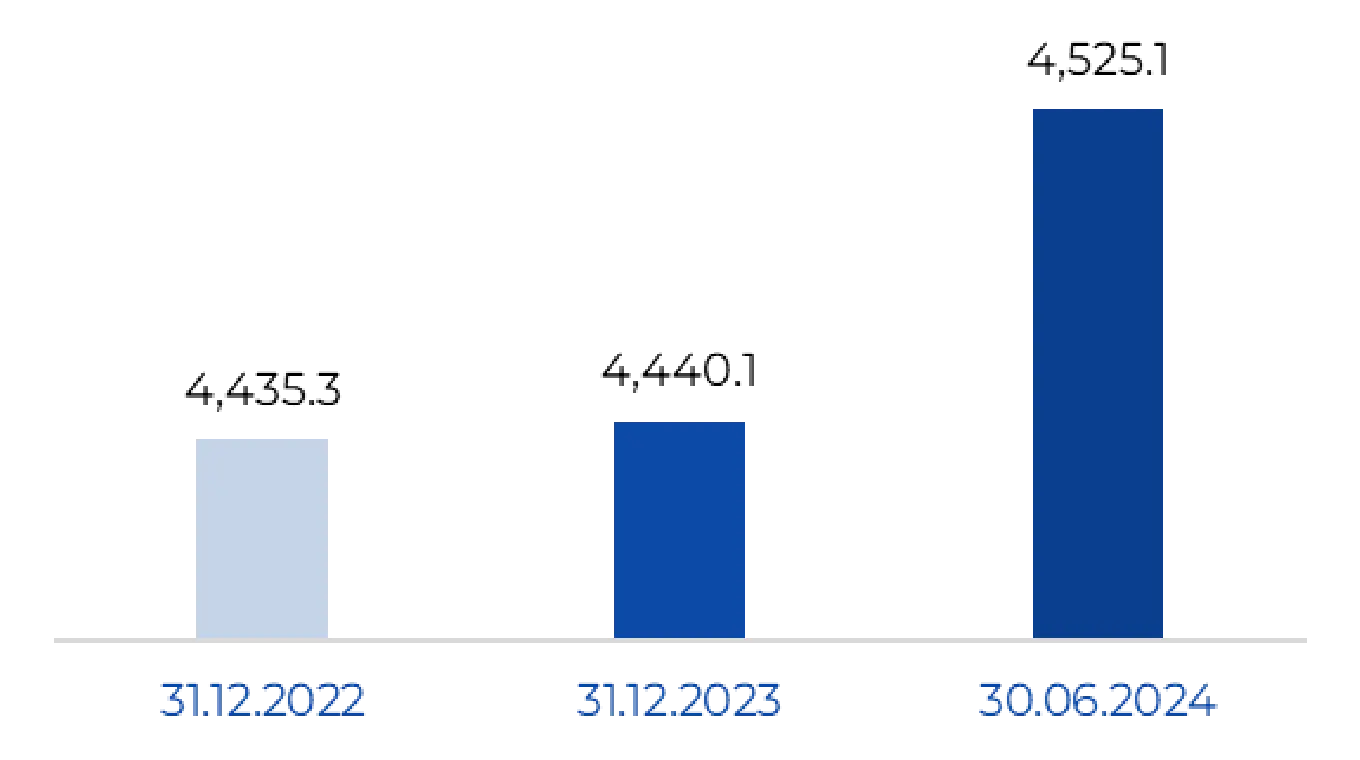

Net fixed assets

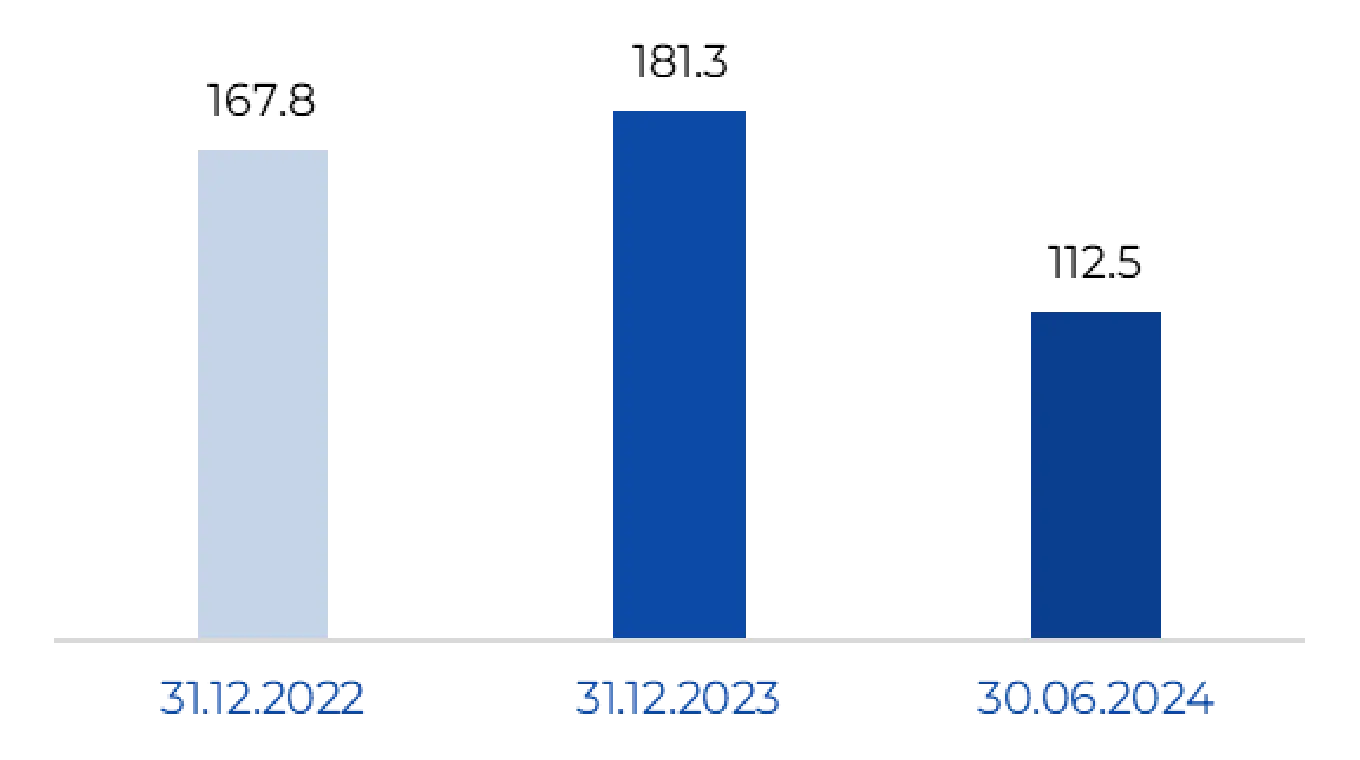

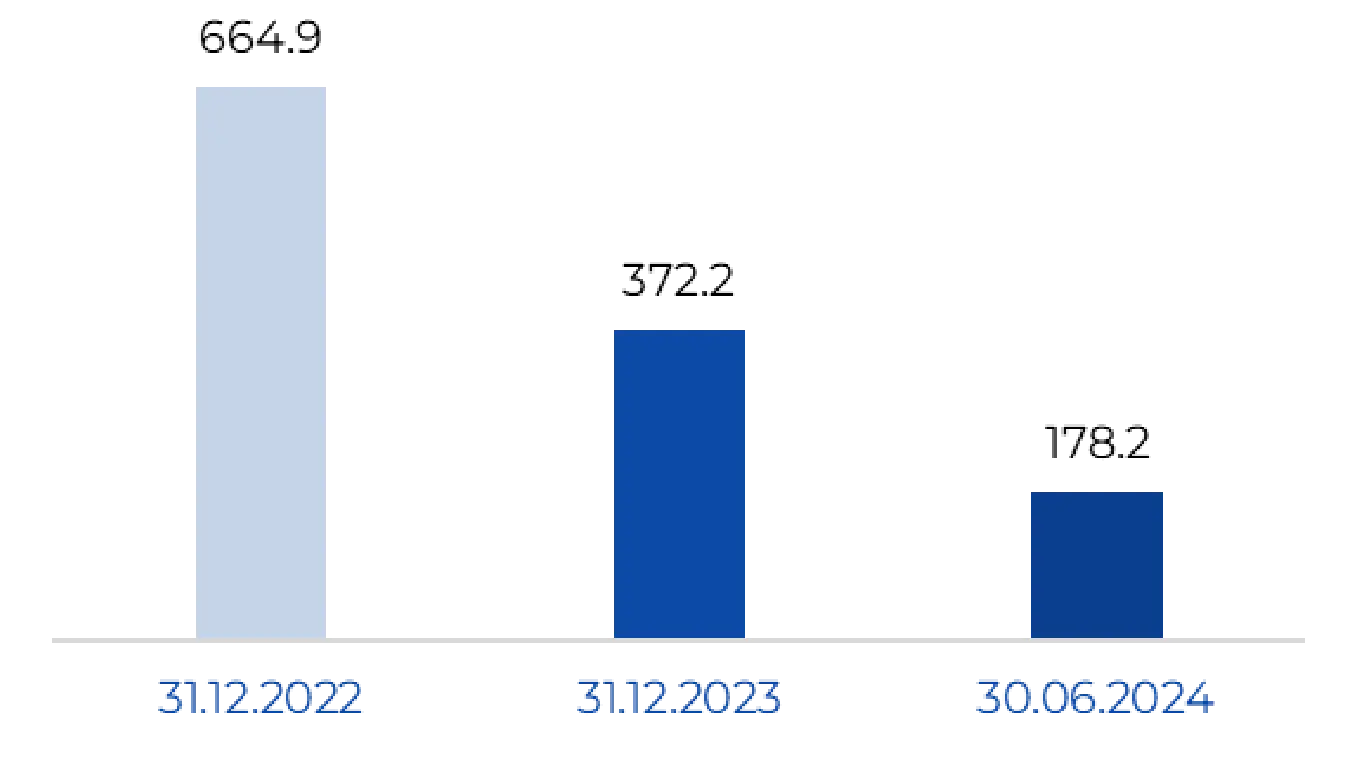

Net Financial Position

*Adjusted data, corrected by extraordinary items.

Documentation for year

Here we have organised all the documents for easy reference, categorised by the relevant year. Among the available documents: the results that include the statements relating to the approval of the results, the financial reports and the non-financial disclosures organised by the relevant semester.

Price sensitive communications

F2i and Finavias have signed an agreement for the sale of their entire shareholding in 2i Rete Gas to Italgas

Milan, 7 October 2024 – On October 5, 2024, F2i and Finavias announced the signing of an agreement for the sale of 2i Rete Gas to Italgas. F2i currently holds 63.9% of 2i Rete Gas and Finavias, a corporate vehicle owned by APG Asset Management and funds managed by...

2I RETE GAS: THE BOARD OF DIRECTORS OF 2i RETE GAS APPROVES THE RESULTS AT JUNE 30th 2024

The Board of Directors of 2i Rete Gas S.p.A. approved today the Consolidated Interim Financial Report at June 30th 2024.

PRESS RELEASE

On February 28, 2024, 2i Rete Gas S.p.A., in agreement with its shareholders - F2i Sgr (owning 63.9%) and, through the vehicle Finavias S.a.r.l. (36.1%), Ardian and APG Asset Management - started, as part of the possible strategic alternatives for maximizing value, a...

Debt and rating

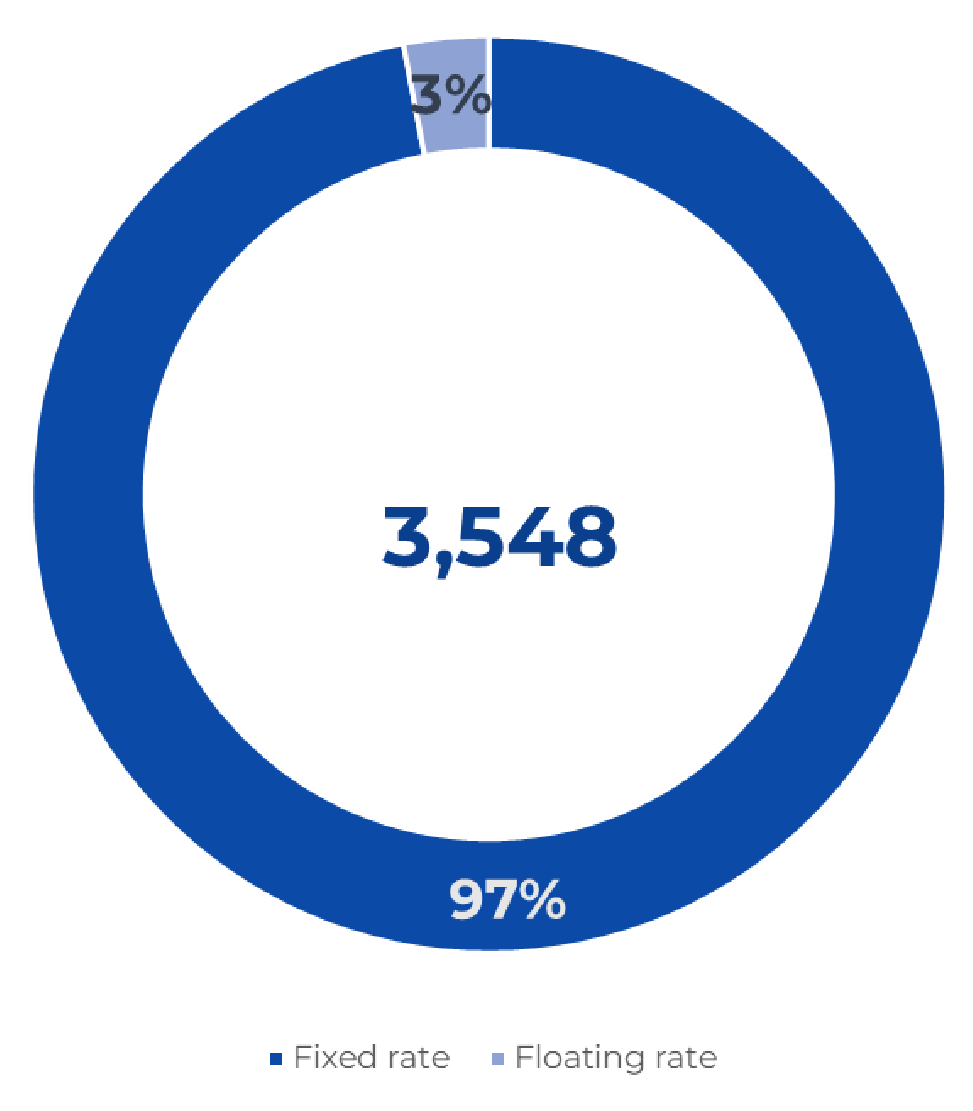

Debt composition

Our debt profile is distinguished by an extended average maturity and a high percentage of fixed-rate debt.

The net financial position as of 30/06/2024 (including IFRS16) is €3,267 million.

3,548 millions of €

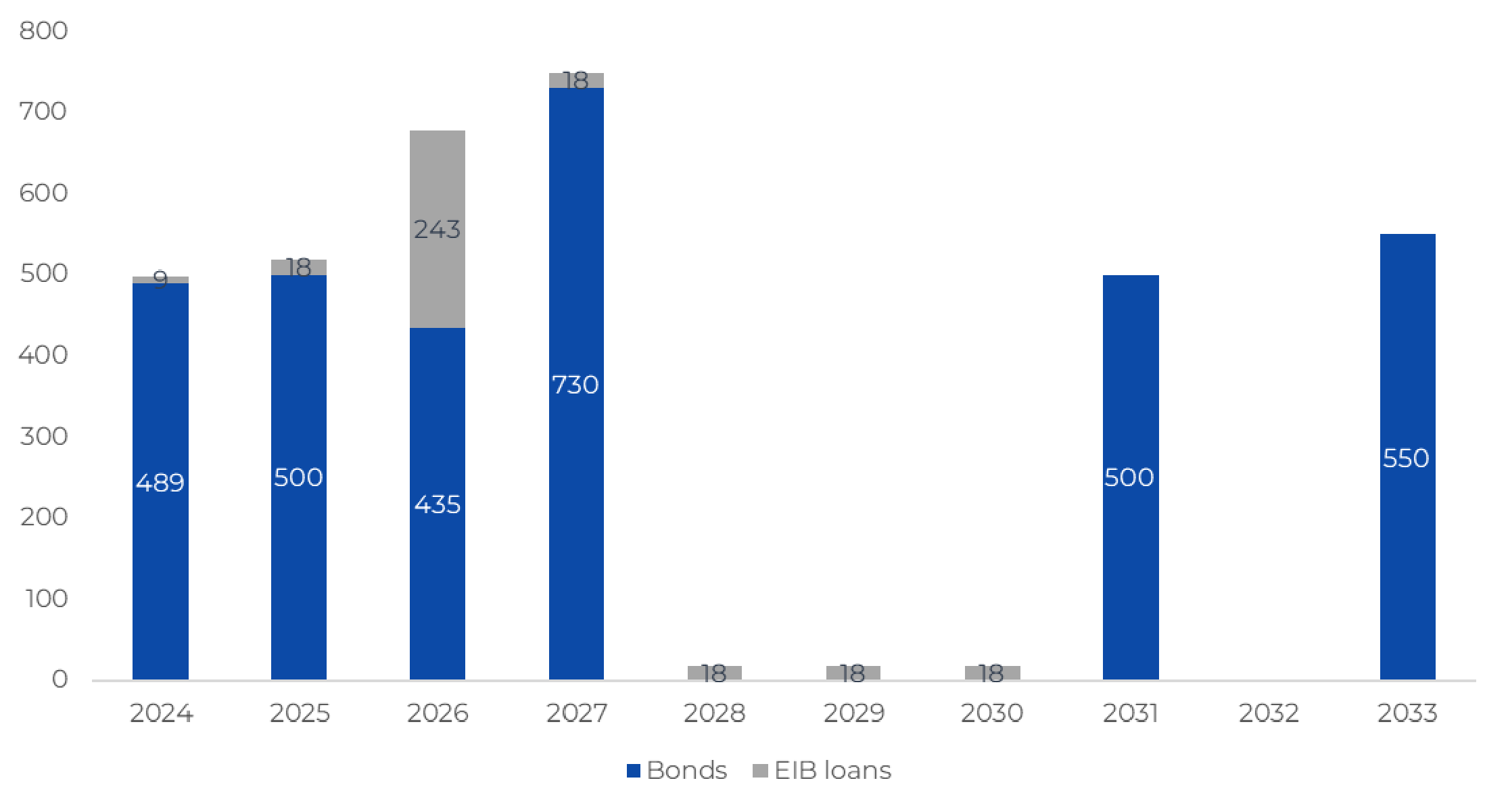

Maturity curve

(millions of €)

Rating

The 2i Rete Gas Rating has been assigned by the two largest independent international agencies: Moody’s e Standard & Poor’s.

The “investment grade” rating from Rating Agencies underscores the robust financial health of 2i Rete Gas.

Agency: Moody’s

Long-term: Baa2

Short-term: Not assigned

Outlook: Stable

Last update: 10 October 2024

Agency: Standard & Poor’s

Long-term: BBB

Short-term: A-2

CreditWatch: Positive

Last update: 9 October 2024

EMTN Programme

The EMTN Programme offers flexibility and security, allowing us to diversify our funding sources and support our innovation and infrastructure development goals in the natural gas distribution sector.

Financial calendar

25.09.2024 – Board of Directors’ meeting for the approval of mid-year results at 30.06.2024

24.04.2024 – Shareholders’ Meeting for the approval of the financial statements and consolidated financial statements as at 31.12.2023 and resolution of the dividend

22.03.2024 – Board of Directors’ meeting for the approval of consolidated results at 31.12.2023

27.09.2023 – Board of Directors’ meeting for the approval of mid-year results at 30.06.2023

27.04.2023 – Shareholders’ Meeting for the approval of the financial statements and consolidated financial statements as at 31.12.2022 and resolution of the dividend

27.03.2023 – Board of Directors’ meeting for the approval of consolidated results at 31.12.2022

Market transparency

2i Rete Gas S.p.A. has been issuing bonds listed on the Irish Stock Exchange (ISE) since 2014, which is an EU regulated market. This initiative forms part of our strategy to diversify financing sources through a medium-term bond program (EMTN), holding the status of a Public Interest Entity under Legislative Decree no. 39 of 27 January 2010.

In compliance with the European Union regulations aimed at ensuring transparency (Transparency Directive) and preventing market abuse (European Parliament and Council Regulation (EU) no. 596 of 16 April /2014, also known as MAR), and relevant application provisions, the Company has adopted:

- an internal dealing procedure, as a procedure that regulates the information obligations on the occasion of transactions carried out by relevant parties on 2i Rete Gas securities;

- a procedure concerning the establishment, maintenance, and updating of the Register of persons with access to inside information of 2i Rete Gas S.p.A. Inside information refers to information of a precise nature that has not been made public, directly or indirectly concerning the issuer or one or more financial instruments, and which, if made public, could significantly affect the prices of such financial instruments or related derivative financial instruments.

- a procedure for public information communication, which outlines the criteria, actions, and responsibilities aimed at ensuring effective and efficient communication of pertinent information to the public.

Investor Relations contacts

For financial and bond-related information contact the 2i Rete Gas S.p.A. Investor Relations department

Via Alberico Albricci 10

20122 Milano

Investor.relations@2iretegas.it